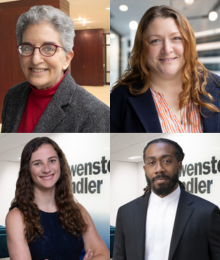

Lowenstein Sandler is pleased to announce that Beth Shapiro Kaufman and Megan E. Wernke have joined the firm as partners in its newly expanded Private Client Services group. They will be based in Lowenstein’s Washington, D.C. office, and will be joined by associates Meghan M. Federman and Molefi McIntosh.

Kaufman joins the firm as National Chair of its robust Private Client Services group, comprised of over 30 lawyers from Lowenstein’s Trusts & Estates, Tax, Family Office, Investment Management, Private Equity/M&A, Debt Finance, Venture Capital, and Real Estate practices who offer dedicated stewardship and personalized strategic advice to families, family offices, private foundations, and family-owned businesses. The group’s services include estate planning, domestic and international taxation, as well as counsel on direct equity and private credit investments by family-owned entities and charitable foundations, corporate transactions, and disputes.

“Over the past few years our firm has seen a meaningful increase in the number of family offices and their affiliates seeking our firm’s advice on a whole range of services, from formation, governance, and planning, through capital deployment, requiring more sophisticated and interdisciplinary planning,” says Lowenstein Chair and Managing Partner Gary M. Wingens. “The strengths that Beth, Megan, Meghan, and Molefi bring to the firm will allow us to further broaden and deepen the ways we support our private clients. This expansion not only increases our footprint in the nation’s capital; it enhances Lowenstein’s leadership in the private client services space.”

Lowenstein’s work for private clients includes the full spectrum of transactions, such as tax-efficient transfers of businesses, real estate, valuable art, and other collections (often with cross-border components); the acquisition of passive or controlling interests in operating businesses; private credit transactions; and investments in custom private equity and venture-style fund structures. The group’s lawyers are highly experienced in developing innovative approaches for complex cross-border gifts, investments, and purchases by individuals and their private investment vehicles. In addition, they address family matters, ranging from tax and estate planning for marriage and divorce to business disputes and fiduciary litigation, all with a common focus: protecting and serving the interests and goals of the individual and family.

Most recently members of the law firm Caplin & Drysdale, Kaufman and Wernke advise high net-worth individuals and family offices on a wide range of sophisticated domestic and international estate planning matters. A large portion of their practice focuses on tax issues, including estate, gift, and generation-skipping transfer taxes, as well as income taxation of trusts and estates. Both ranked by Chambers USA as leading lawyers for their work in High Net Worth: Private Wealth Law, they frequently represent clients before the IRS in ruling requests, audits, appeals, and in Tax Court.

Kaufman has over 25 years of experience providing advice on complex estate planning issues. For over six years, Kaufman served in the U.S. Treasury Department's Office of Tax Policy, where she held principal responsibility for all tax policy matters affecting trusts and estates, including estate, gift, and generation-skipping transfer taxes, in addition to income taxation of trusts and estates. A member of the adjunct faculty of Georgetown University Law Center, Kaufman received her undergraduate degree from Pomona College and her law degree from Harvard Law School.

“Those of us in the trusts and estates bar consider Beth Kaufman to be trusts and estates royalty: among many other accomplishments, she basically wrote the rules on generation-skipping wealth transfers,” says Warren K. Racusin, chair of the firm’s Trusts & Estates practice. “We are thrilled that she, Megan, and their talented colleagues will be joining us.”

Kaufman says: “I was looking for two things: a group of colleagues I would enjoy working with, and a firm that could provide a range of services that would benefit my clients. I found both of those here at Lowenstein.”

In addition to counseling high-net-worth individuals and the fiduciaries of large estates and trusts on both domestic and international tax and estate planning, Wernke has significant experience in all stages of tax controversies, including IRS audits, appeals, and litigation. She received her undergraduate degree from Princeton University and her law degree from Harvard Law School.

Federman and McIntosh were both associates at Caplin & Drysdale where they worked with Kaufman and Wernke on estate planning, tax issues, and disputes. Federman provides comprehensive and personalized estate planning advice in the development and administration of estate plans, trusts, and succession plans that facilitate the growth and preservation of multi-generational wealth. Her practice focuses on counseling business owners and entrepreneurs on business succession plans that promote their legacies, values, and objectives. She earned her J.D. cum laude from Harvard Law School and holds a B.A. from Yale University.

McIntosh provides counsel to high-net-worth individuals on tax-sensitive estate planning, with a particular focus on cross-border tax issues. He holds an LL.M. from Georgetown University Law Center, a J.D. from Howard University School of Law, and B.A. magna cum laude from Howard University; prior to his legal career, he worked in international tax and transactions at a Big Four accounting firm.

About Lowenstein Sandler LLP

Lowenstein Sandler LLP is a national law firm with over 350 lawyers based in New York, Palo Alto, New Jersey, Utah, and Washington, D.C. The firm represents leaders in virtually every sector of the global economy, with particular emphasis on investment funds, life sciences, and technology. Recognized for its entrepreneurial spirit and high standard of client service, the firm is committed to the interests of its clients, colleagues and communities.