Lowenstein Sandler represented its longtime client Inrad Optics, Inc. (OTCMKTS:INRD) a provider of advanced optical components, assemblies and systems, in its definitive merger agreement to be acquired by Luxium Solutions, an affiliate of private equity firms SK Capital Partners and Edgewater Capital Partners in an all-cash transaction that values Inrad Optics at approximately $19 million, including assumed debt.

Following the closing of the transaction, Inrad Optics expects to benefit from the significant resources, operational expertise and capacity for investment provided by Luxium, SK Capital and Edgewater. Under the new ownership, Inrad Optics will be able to accelerate investments in technologies that are vital to development of next generation bent X-ray crystal monochromators for spectroscopy and plasma fusion applications, and large-format, ultra-high precision optical components and assemblies.

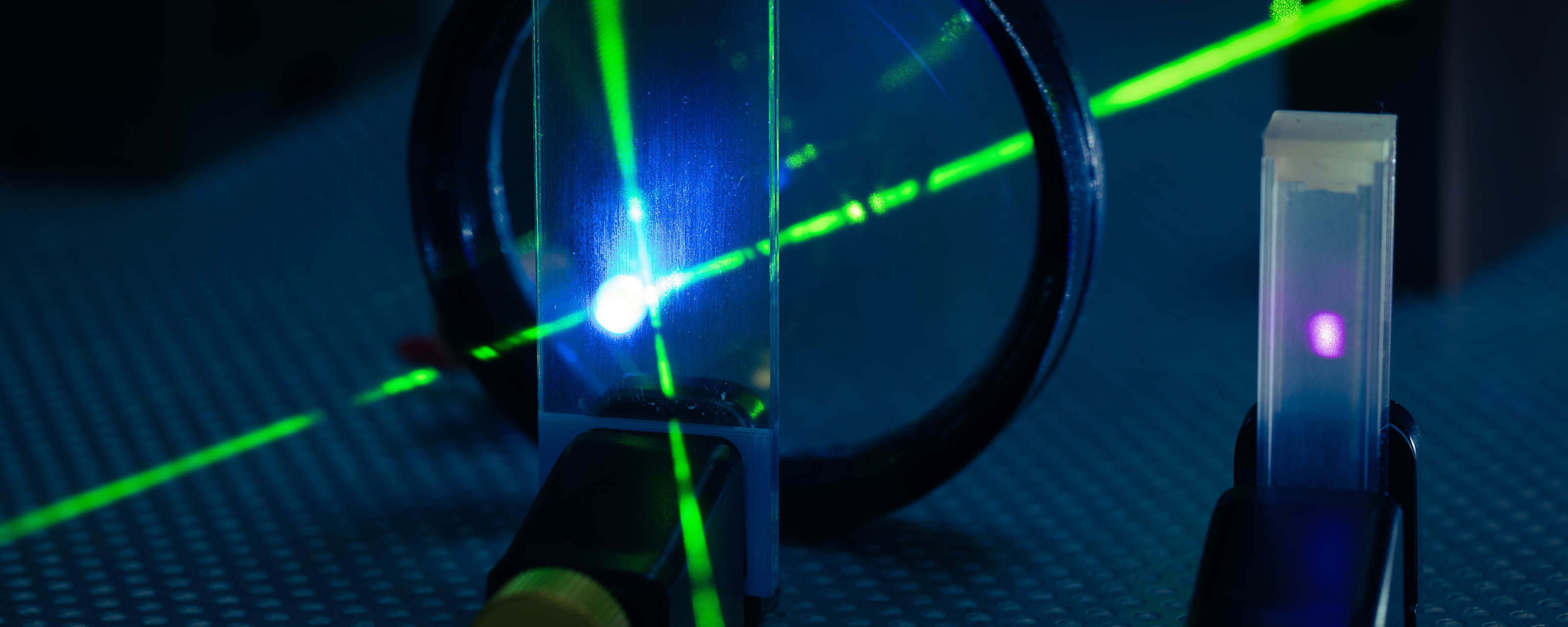

Inrad Optics is a vertically integrated manufacturer specializing in glass, crystal, and metal based optical components and assemblies. Manufacturing capabilities include super-precision optical surfacing, precision diamond turning, the ability to handle large substrates, proprietary optical contacting processes, thin film coatings, and high resolution in-process metrology. Inrad Optics’ customers include leading corporations in semiconductor wafer inspection, industrial and scientific process control and metrology, defense, space, and laser systems sectors, as well as the U.S. Government, National Laboratories and universities and institutions worldwide.

Headquartered in Hiram, Ohio, Luxium is recognized as a worldwide technology leader and provider of single crystal scintillation materials for radiation detection applications, as well as sapphire and garnet substrates for photonics and power electronics. Luxium serves a global base of 650+ customers across a diverse set of applications across medical imaging, security and border protection, semiconductor, aerospace and defense, oil and gas, and other industrial markets.

The Lowenstein deal team included Alan Wovsaniker, Jean Nicolas "Nick" Samedi, Jr., David J. Yovanoff, Tracy F. Buffer, Nicola E. Perzichilli, Megan Monson, Michael Walutes, and Mark S. Heinzelmann.